Shopping Center - Market Insights

Market Overview

Universe Overview:

16,959

Shopping Centers across North America

4.39B

Square feet of GLA

355,704

Retail locations

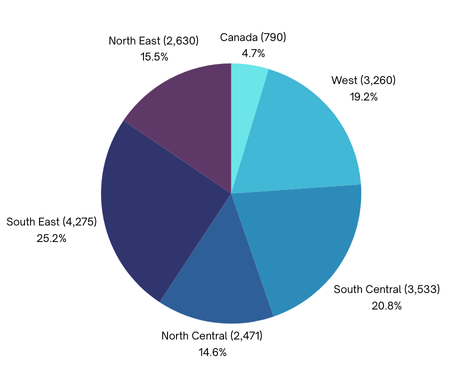

Market Distribution

Regional Shopping Center Distribution

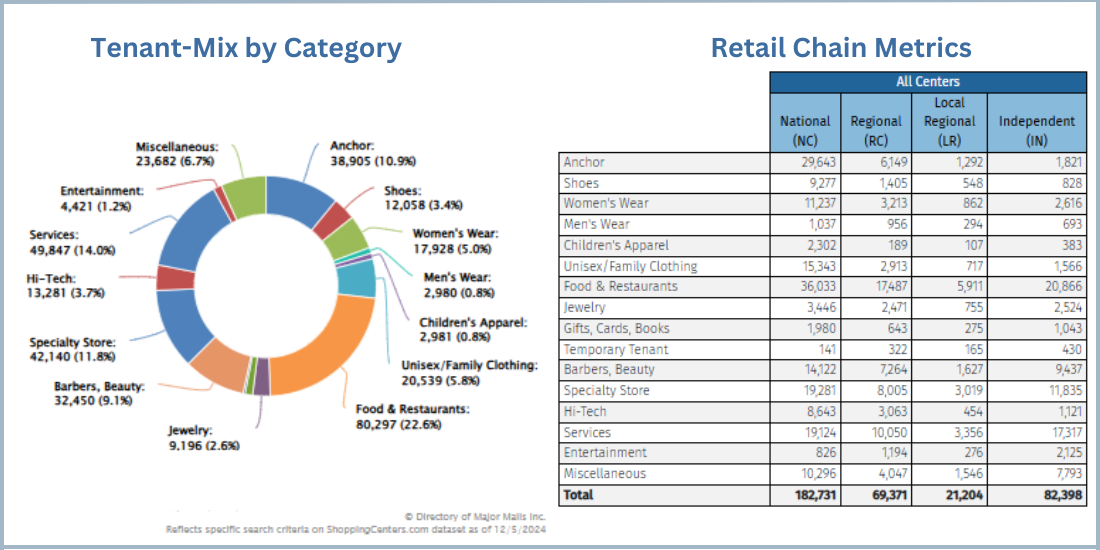

Retail Chain Types

National Chains

51.4% (182,731 locations)

Independent Retailers

23.2% (82,398 locations)

Regional Chains

19.5% (69,371 locations)

Local Regional

6% (21,204 locations)

Tenant Mix & Industry Leaders

Tenant Mix Highlights

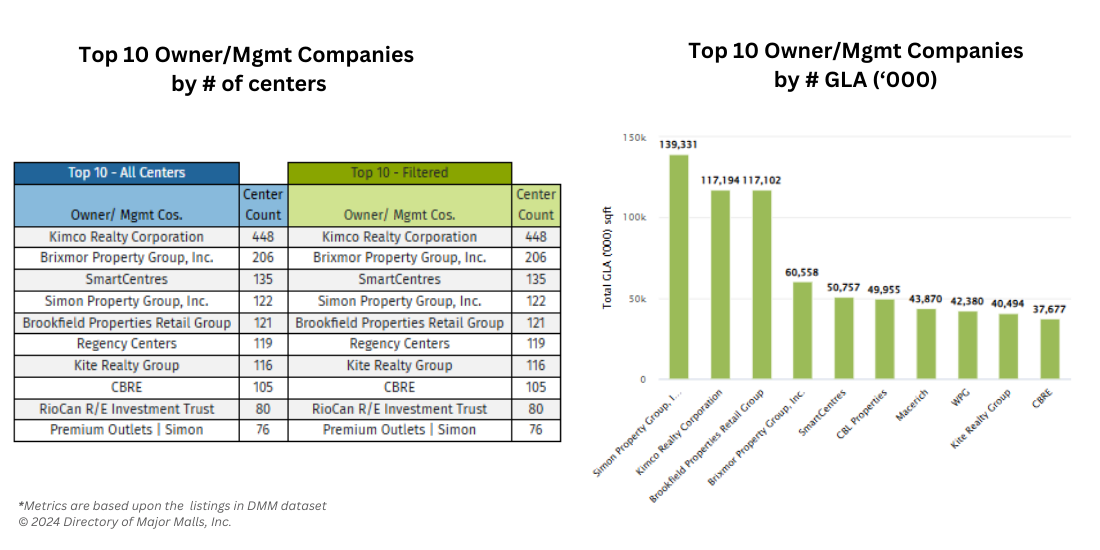

Industry Leaders

By Total Retail GLA

- Simon Property Group 139,331K sq ft

- Kimco Realty Corporation ~117K sq ft

- Brookfield Properties ~117K sq ft

By Number of Properties

- Kimco Realty Corporation 448 centers

- Brixmor Property Group, Inc. 206 centers

Market Trends & Analysis

Qualifying the Income in a Retail Property Acquisition

Due diligence can be cumbersome, but rushing through the process can cause a buyer to pay more than the shopping center is worth.

With borrowing costs expected to continue trending down next year, transactions of open-air community centers are likely to increase, possibly to a level not seen since 2021, as interest rates level off and valuations become more apparent to sellers and buyers. After two years of sluggish dispositions, sellers will want to monetize their real estate assets, some burdened by high-interest-rate loans.

As the market for retail properties ramps up, many new buyers will seek to acquire "value-add" retail properties that can be leased up and fixed to improve cash flow and valuation. Many of the acquisition targets will be properties whose anchors shuttered in the past few years where owners didn't have the resources to replace the vacant anchor spaces. Vacating anchors not only reduce the properties' cash flow, but these vacancies can topple specialty tenants as part of a domino effect.

Market Updates

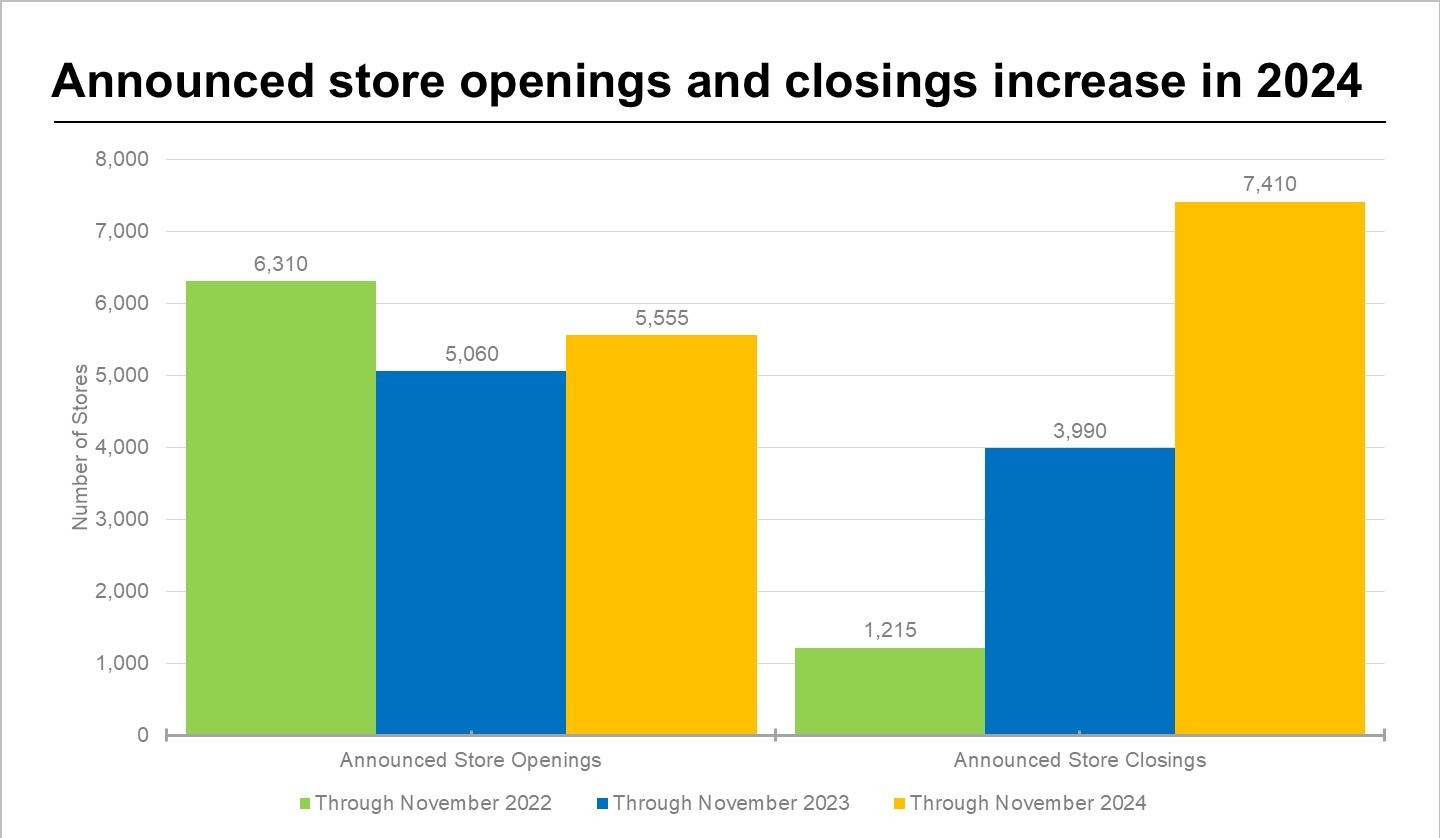

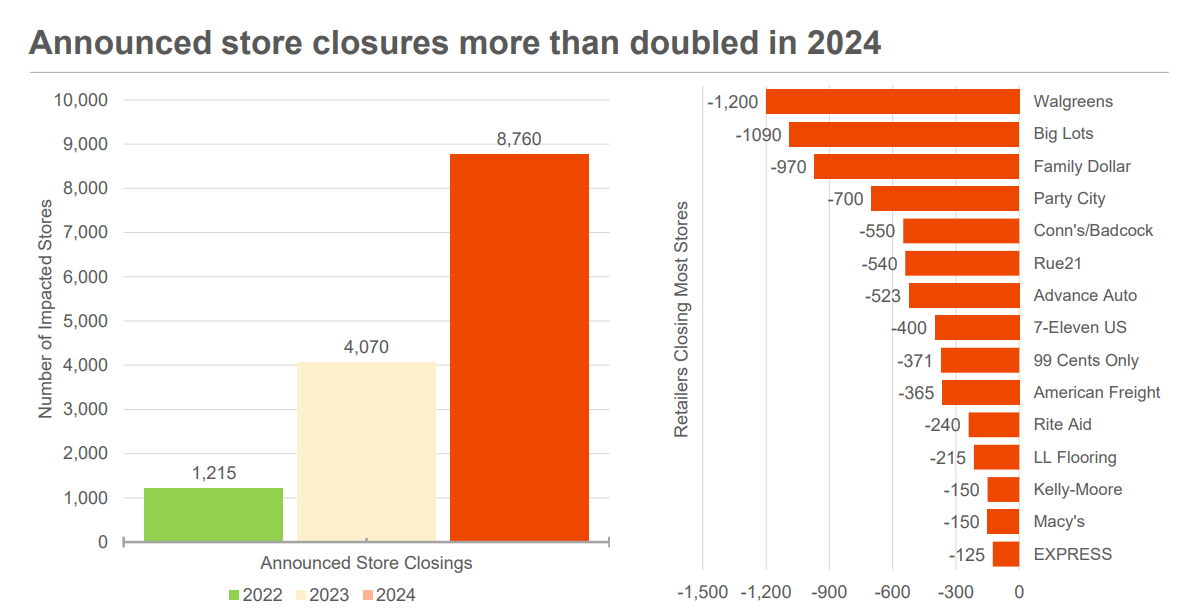

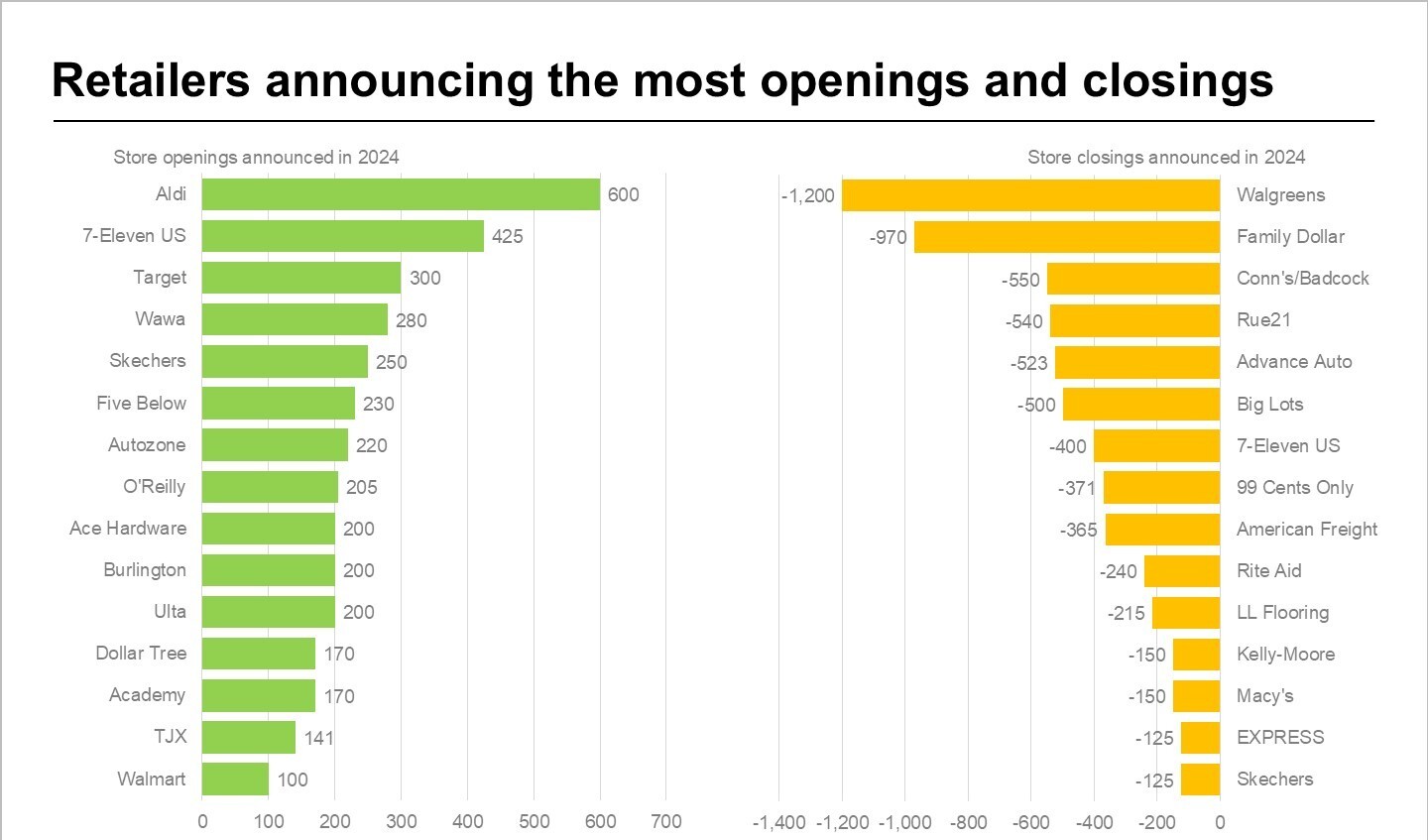

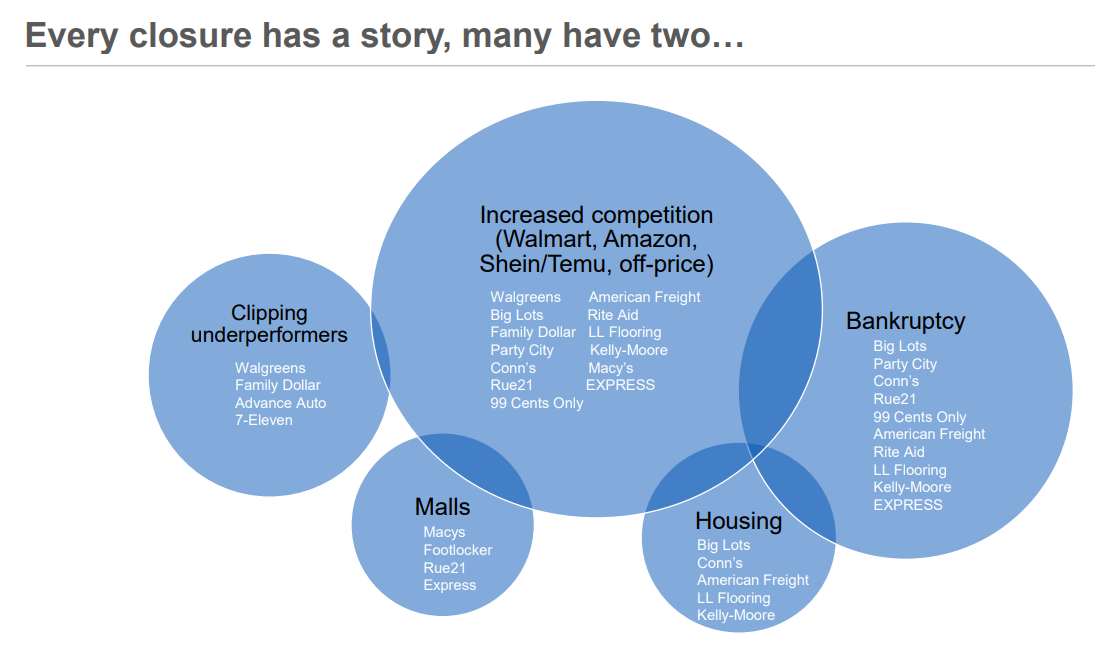

Store Closures Trend

Announced store closures more than doubled in 2024:

Case Study: Clackamas Town Center Mall

Clackamas Town Center mall in Happy Valley, Oregon, is grappling with a $191 million mortgage default, adding to the woes of American malls struggling with changing consumer habits and declining retail space.

- Built in 1981

- Purchased in 2002 for $634 million

- Valued at $342 million in 2022 (↓7.5% from 2012)

- Acquired by Brookfield Property Partners L.P. in 2018

- Added 250,000 sq ft in 2007 renovation

Federal Property Market

Editor's note: This story has been updated to note that, after this report was published, the U.S. General Services Administration removed from its website a list of buildings for sale across the United States, including in Oregon.

The Trump administration intends to put 10 federal buildings up for sale in Oregon, according to the U.S. General Services Administration. They're among hundreds of federal properties across the country "designated for disposal" in a list published Tuesday.

Portland Metro Area

- 911 Federal Building

- BPA Building

- Edith Green-Wendell Wyatt Federal Building

- Troutdale Metal Shed

- Troutdale Warehouse

Other Oregon Locations

- David J Wheeler Federal Building, Baker City

- Eugene Federal Building, Eugene

- James A. Redden U.S. Courthouse, Medford

- USGS Building, Medford

- USGS Warehouse, Medford

In Southwest Washington, the Vancouver Federal Building was also marked for possible sale, according to the GSA records.

Retail Sector Outlook

2025 Retail Real Estate Forecast

Positive Trends

- • Retail sales expected to grow 3.2-3.8%

- • Neighborhood centers showing strong performance

- • Experiential retail continuing to expand

- • Grocery-anchored centers remain investor favorites

Challenges

- • Regional mall vacancies increasing

- • Department store closures accelerating

- • E-commerce competition intensifying

- • Rising construction costs limiting new development

Retail real estate is experiencing a significant transformation as consumer preferences evolve and technology reshapes shopping behaviors. While traditional enclosed malls face challenges, open-air centers, particularly those anchored by grocery stores or offering experiential retail, continue to perform well. Investors are increasingly focused on properties in high-growth suburban markets with strong demographic profiles.

Investment Opportunities

Value-Add Opportunities

The current market presents significant opportunities for investors to acquire underperforming retail assets at attractive valuations. Properties with the following characteristics offer particularly compelling value-add potential:

- • Centers with vacant anchor spaces that can be repositioned

- • Properties in growing suburban markets with strong demographics

- • Assets with below-market rents and upcoming lease expirations

- • Centers with redevelopment potential for mixed-use conversion

Cap Rate Trends

Cap rates for retail properties have shown significant variation based on property type and location:

Grocery-Anchored

5.5% - 6.25%

Neighborhood Centers

6.0% - 7.0%

Power Centers

7.0% - 8.5%

Regional Malls

8.5% - 12.0%+

Emerging Retail Concepts

Experiential Retail

Retailers focusing on creating immersive in-store experiences that cannot be replicated online. Examples include interactive displays, in-store events, and personalized shopping services.

Omnichannel Integration

Retailers seamlessly blending physical and digital shopping experiences through technologies like BOPIS (Buy Online, Pick-up In Store), mobile apps with in-store features, and digital showrooms.

Micro-Fulfillment Centers

Small-scale distribution facilities often located within existing retail spaces or nearby to facilitate rapid order fulfillment and last-mile delivery for e-commerce operations.

Conclusion & Resources

The retail real estate landscape continues to evolve rapidly, presenting both challenges and opportunities for investors, developers, and retailers. While certain traditional retail formats face headwinds, innovative concepts and strategic repositioning are creating new value in the sector. Understanding market trends, consumer behavior shifts, and property-specific factors remains essential for successful investment and development in this dynamic environment.

Additional Resources

ICSC Research & Publications

Industry insights, trends, and data from the International Council of Shopping Centers

Marcus & Millichap Research

Market reports and analysis from the leading commercial real estate investment firm

NAR Commercial Market Insights

National Association of Realtors commercial real estate market data and analysis

Retail Dive

News and analysis on retail industry trends, technology, and innovation